When we think of disruption, we often picture service delays or breakdowns. But the real shake-up is happening in how carriers are competing...

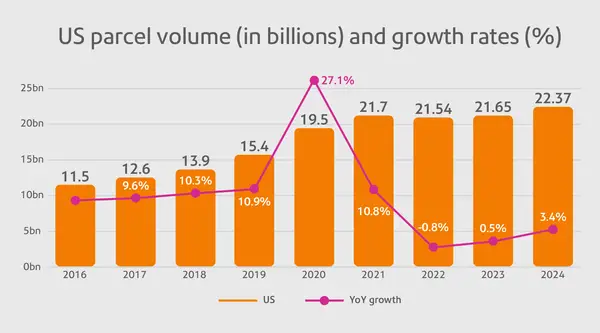

In 2024, U.S. parcel volume saw significant growth, reaching 22.37 billion shipments, a 3.4% increase from 2023’s 21.65 billion. This growth trend is expected to continue, with projections showing volumes reaching 30 billion by 2030.

However, revenue growth hasn’t kept up with the rise in volume. In 2024, total revenue grew by just 2.7%, from $197.9 billion in 2023 to $203.2 billion — slower than the increase in parcel volume.

Competitive pricing is intensifying and alternatives are emerging

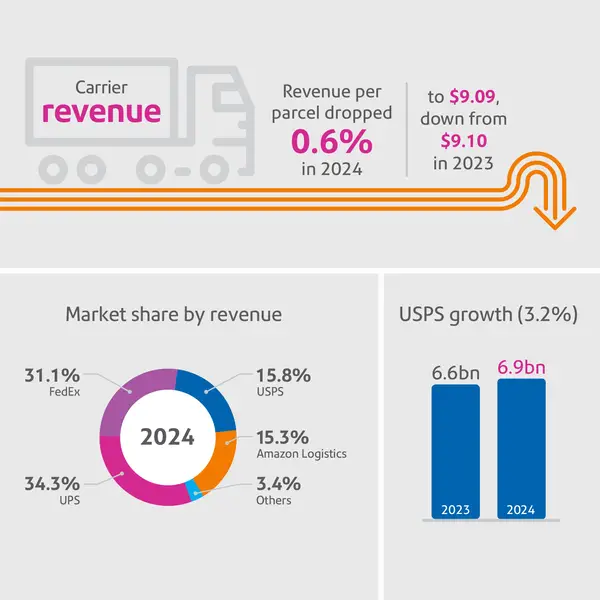

To capture a larger market share, carriers are increasingly offering competitive pricing, which is leading to lower revenue per parcel. In fact, revenue per parcel dropped 0.6% in 2024, to $9.09, down from $9.10 in 2023.

This pricing pressure is largely driven by the rapid growth of alternative carriers, as well as USPS’ new low-cost shipping option, Ground Advantage. This service has helped USPS grow for the first time since 2020, reaching 6.9 billion parcels in 2024, up from 6.6 billion in 2023.

Since we began tracking shipments in 2015, the parcel market had been dominated by the Big 3: FedEx, UPS, and USPS.

However, Amazon Logistics — once a small competitor — is closing the gap rapidly. In 2024, Amazon handled 6.3 billion parcels, just behind USPS’ 6.9 billion. By 2028, Amazon is projected to overtake USPS, with 8.4 billion parcels versus USPS’ 8.3 billion.

The “others” category comprised of smaller carriers continued growth trajectory and experienced their combined volume grow 22.6%. This trend indicated a long-term transformation in the economics of last-mile delivery, favoring smaller packages and more affordable shipping options.

Tariffs could introduce disruption and produce new opportunities

The newly imposed tariffs are still being fully understood, but they’re expected to affect carrier cross-border shipping costs and disrupt supply chains. with longer delivery times for international shipments.

Disruption presents opportunities for new carriers. New final-mile and regionally-specialized carriers could capitalize on the growing demand for localized, cost-effective shipping solutions in markets where the larger international carriers may struggle to offer affordable services.

With carriers facing increasing competition and evolving service offerings, it’s essential to have flexibility in your choice of shipping providers. Leveraging shipping technology that grants access to multiple carriers — and comes with pre-negotiated discounted rates — gives you the flexibility to adapt to shifting dynamics in the market.

By staying agile, you can navigate changes and be prepared for future service innovations. To keep your options open and always find the best rates, work with a multicarrier shipping technology provider like Pitney Bowes that continuously enables you to make the best shipping choices on everything you send.